reverse sales tax calculator ontario

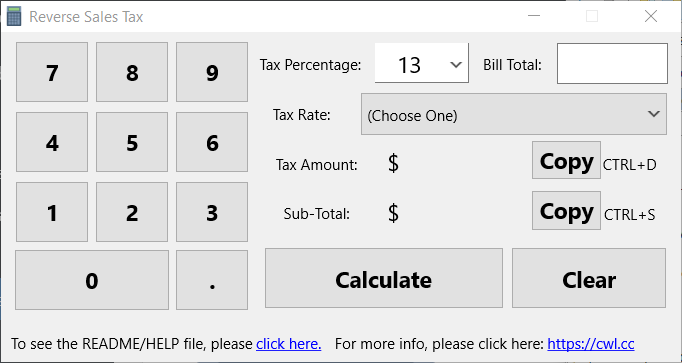

Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below. Business professional commission partnership fishing and farming income.

How To Calculate Sales Tax Backwards From Total

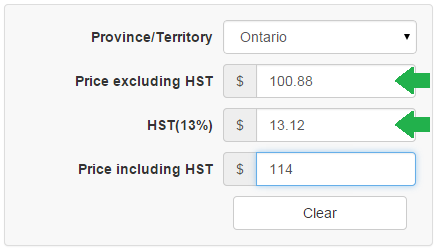

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13.

. Enter HST value and get HST inclusive and HST exclusive prices. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. In general these are dividends received from public companies.

Use our simple 2021 tax calculator to quickly estimate your federal and provincial taxes. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. HST Tax Rate. There are times when you may want to find out the original price of the items youve purchased before tax.

The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. The following table provides the GST and HST provincial rates since July 1 2010. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and the amount of sales tax that was in the total price.

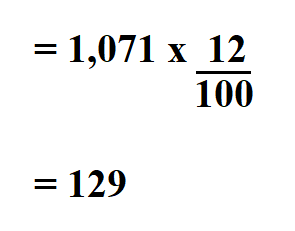

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. This is the after-tax amount. Enter price without HST HST value and price including HST will be calculated.

Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price. The HST is made up of two components. Ensure that the Find Subtotal before tax tab is selected.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is. 13 for Ontario 15 for others.

An 8 provincial sales tax and a 5 federal. Ontariotaxcalculator is a simple efficient and easy to use tool in ontario to calculate sales tax hst. GSTHST provincial rates table.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. That entry would be 0775 for the percentage.

The HST was adopted in Ontario on July 1st 2010. The County sales tax rate is. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value.

Employment income and taxable benefits. Who the supply is made to to learn. Amount without sales tax x HST rate100.

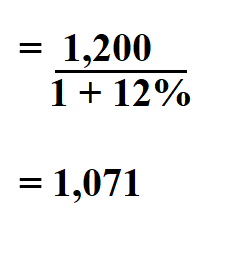

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Amount with sales tax 1 HST rate100 Amount without sales tax. The given number will be the pre-HST number that will be calculated.

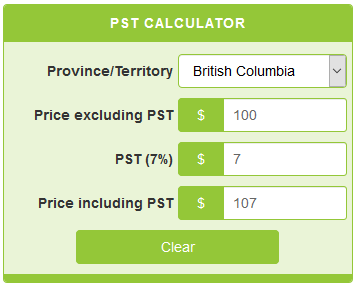

Any input field can be used. The rate you will charge depends on different factors see. Sales Taxes in Quebec.

Formula for reverse calculating HST in Ontario. The period reference is from january 1st 2021 to december 31 2021. If you want a reverse HST calculator the above tool will do the trick.

Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse. The California sales tax rate is currently. Choose which one you are using in the drop-down menu.

This valuable tool has been updated for with latest figures and rules for working out taxes. Instead of using the reverse sales tax calculator you can compute this manually. You have a total price with HST included and want to find out a price without Harmonized Sales Tax.

Calculates the canada reverse sales taxes hst gst and pst. Where the supply is made learn about the place of supply rules. Calculates the canada reverse sales taxes HST GST and PST.

The minimum combined 2022 sales tax rate for Ontario California is. The total amount of your capital gains. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

The second script is the reverse of the first. You will need to input the following. Amount without sales tax GST rate GST amount.

This is very simple HST calculator for Ontario province. To calculate the subtotal amount and sales taxes from a total. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions CPP and EI.

Amount without sales tax QST rate QST amount. Province of Sale Select the province where the product buyer is located. Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018.

Theres no need of remembering the formula on your mind since our calculator does it all for you. You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975.

Sales tax amount or rate. Type of supply learn about what supplies are taxable or not. Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850.

New brunswick newfoundland and labrador nova scotia ontario and prince edward island. Here is how the total is calculated before sales tax. This is the total of state county and city sales tax rates.

This reverse sales tax calculator will calculate your pre-tax price or amount for you. It is very easy to use it. How to Calculate Reverse Sales Tax.

Following is the reverse sales tax formula on how to calculate reverse tax. Reverse Sales Tax Formula. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013.

In that area you will in need of relying on a Reverse Sales Tax Calculator and guess what weve got that too on our page for your convenience. Sometimes you might need to figure out the total amount to pay without the sales tax amount added to it. This is particularly useful if you sell merchandise on a tax included basis and then must determine how much.

OP with sales tax OP tax rate in decimal form 1. To find the original price of an item you need this formula. 2021 Income Tax Calculator Ontario.

Calculate the total income taxes of the Ontario residents for 2021. Enter the final price or amount. Margin of error for HST sales tax.

The Ontario sales tax rate is.

Reverse Hst Calculator Hstcalculator Ca

Pst Calculator Calculatorscanada Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Sales Tax Calculator 100 Free Calculators Io

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Canada Sales Tax Calculator By Tardent Apps Inc